Introduction

What is estate planning?

Estate planning is the process of making a plan in advance and managing your assets during your lifetime and beyond. It involves determining how your assets will be distributed after your death and ensuring that your loved ones are taken care of. Estate planning is not just for the wealthy; it is for anyone who wants to protect their assets and ensure that their wishes are carried out. By creating an estate plan, you can minimize taxes, avoid probate, and provide for your family’s financial security. It is a crucial step in securing your legacy and ensuring that your hard-earned assets are passed on according to your wishes.

Importance of estate planning

Estate planning is a crucial step in ensuring the protection and distribution of your assets according to your wishes. It involves making legal arrangements for the management of your estate, including your property, finances, and personal belongings, both during your lifetime and after your passing. By engaging in estate planning, you can have peace of mind knowing that your loved ones will be taken care of and your assets will be distributed in the way you desire. Additionally, estate planning allows you to minimize taxes, avoid probate, and provide for any special needs or circumstances that may arise. It is an essential process for anyone who wants to safeguard their hard-earned assets and ensure a smooth transition for their beneficiaries.

Common misconceptions about estate planning

Estate planning is often surrounded by common misconceptions that can lead individuals to make uninformed decisions. One of the most prevalent misconceptions is that estate planning is only for the wealthy. In reality, estate planning is essential for individuals of all income levels as it allows for the protection and distribution of assets according to one’s wishes. Another misconception is that estate planning is only necessary for older individuals. However, accidents or unexpected events can occur at any age, making it important for individuals of all ages to have a well-thought-out estate plan in place. By debunking these misconceptions, individuals can gain a better understanding of the importance of estate planning and take the necessary steps to protect their assets.

Understanding Your Assets

Types of assets

There are various types of assets that individuals may own, each with its own unique characteristics and considerations for estate planning. Common types of assets include real estate properties, such as homes, land, and commercial buildings, which can hold significant value and require careful planning for their transfer. Financial assets, such as bank accounts, investment portfolios, and retirement accounts, are also important to consider in estate planning to ensure their proper distribution. Additionally, personal possessions like jewelry, artwork, and collectibles may hold sentimental or monetary value and should be accounted for in an estate plan. It is crucial to understand the different types of assets one owns and their specific requirements in order to effectively protect and distribute them in accordance with one’s wishes.

Valuing your assets

Valuing your assets is a crucial step in the estate planning process. It involves determining the worth of your possessions, properties, and investments. By accurately assessing the value of your assets, you can make informed decisions about how to protect and distribute them. This includes considering factors such as market conditions, appraisals, and professional evaluations. Valuing your assets ensures that you have a clear understanding of your financial standing and enables you to create an effective estate plan that aligns with your goals and objectives.

Identifying ownership and beneficiaries

Identifying ownership and beneficiaries is a crucial step in estate planning. It involves determining who owns the assets and who will inherit them after the owner’s passing. This process ensures that the assets are distributed according to the owner’s wishes and helps avoid any potential disputes or confusion among family members. By clearly identifying ownership and beneficiaries, individuals can ensure that their hard-earned assets are protected and passed on to their loved ones in a smooth and efficient manner.

Estate Planning Documents

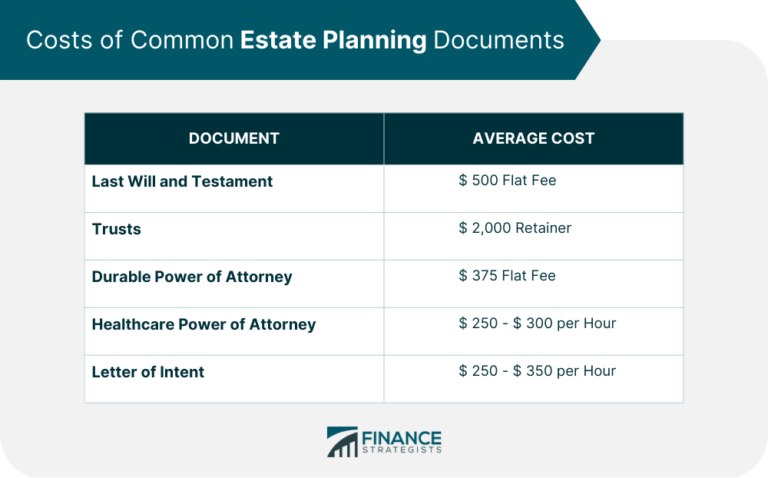

Last Will and Testament

A Last Will and Testament is a crucial document in estate planning. It allows individuals to specify how their assets and property should be distributed after their death. This legal document ensures that your wishes are carried out and provides clarity to your loved ones regarding your final wishes. By creating a Last Will and Testament, you can ensure that your assets are transferred to the intended beneficiaries and minimize any potential disputes or conflicts among family members. It is important to regularly review and update your Last Will and Testament to reflect any changes in your financial situation or personal circumstances.

Revocable Living Trust

A revocable living trust is a key component of estate planning that allows individuals to maintain control over their assets while also providing flexibility and privacy. Unlike a will, a revocable living trust allows assets to pass directly to beneficiaries without going through probate, which can be a lengthy and costly process. Additionally, a revocable living trust can be amended or revoked during the individual’s lifetime, providing the ability to make changes as circumstances change. This type of trust also offers privacy, as it does not become part of the public record like a will does. Overall, a revocable living trust is an effective tool for protecting assets and ensuring a smooth transfer of wealth to intended beneficiaries.

Power of Attorney

A Power of Attorney is a legal document that grants someone the authority to act on your behalf in financial and legal matters. It is an important part of estate planning as it allows you to designate a trusted individual to make decisions and handle your affairs if you become incapacitated or unable to manage them yourself. With a Power of Attorney, you can ensure that your financial and legal matters are taken care of according to your wishes, even if you are unable to actively participate. It is crucial to choose someone reliable and trustworthy as your attorney-in-fact, as they will have the power to make important decisions on your behalf.

Protecting Your Assets

Asset protection strategies

Asset protection strategies are essential for safeguarding your hard-earned assets. In today’s unpredictable world, it is crucial to have a plan in place to protect your wealth from potential risks and legal liabilities. There are various strategies you can employ to ensure the security of your assets, such as creating trusts, establishing limited liability companies, and utilizing insurance policies. By implementing these strategies, you can minimize the chances of losing your assets to lawsuits, creditors, or unforeseen circumstances. It is important to consult with a qualified estate planning attorney who can guide you through the process and help you choose the most effective asset protection strategies for your specific needs.

Insurance coverage

Insurance coverage is an essential aspect of estate planning as it helps protect your assets and provide financial security for your loved ones. Having the right insurance policies in place ensures that your assets, such as your home, vehicles, and valuable possessions, are adequately covered in case of unforeseen events like natural disasters, accidents, or theft. Additionally, insurance coverage can also include life insurance, which can provide a payout to your beneficiaries upon your passing, helping to replace any lost income and cover expenses. By carefully considering and obtaining the appropriate insurance coverage, you can have peace of mind knowing that your assets are protected and your loved ones are financially secure.

Business succession planning

Business succession planning is a crucial aspect of estate planning, especially for business owners. It involves creating a strategy to ensure the smooth transition of a business to the next generation or chosen successors. By implementing a well-thought-out succession plan, business owners can protect their assets and ensure the continued success of their business even after they are no longer able to actively manage it. This involves identifying and grooming potential successors, establishing clear roles and responsibilities, and implementing mechanisms such as buy-sell agreements or trusts to facilitate the transfer of ownership. Business succession planning is not only important for the longevity of the business but also for the financial security of the owner’s family and loved ones. It allows for a seamless transition, minimizes the risk of conflicts or disputes, and provides a solid foundation for the future of the business.

Minimizing Estate Taxes

Understanding estate taxes

Understanding estate taxes is crucial when it comes to estate planning. Estate taxes are taxes imposed on the transfer of wealth after a person passes away. These taxes can significantly impact the value of an estate and the assets that are left behind. By understanding how estate taxes work, individuals can make informed decisions to minimize their tax liability and ensure their assets are protected for future generations. It is important to consult with a qualified estate planning attorney or financial advisor to navigate the complexities of estate taxes and develop a comprehensive plan that meets your specific needs and goals.

Tax planning strategies

Tax planning strategies are an essential aspect of estate planning. By implementing effective tax planning strategies, individuals can minimize their tax liabilities and maximize the value of their assets. One common tax planning strategy is the use of trusts, which can help to reduce estate taxes and provide control over the distribution of assets. Another strategy is gifting, where individuals can transfer assets to their beneficiaries during their lifetime, thereby reducing the size of their taxable estate. Additionally, taking advantage of tax deductions and credits, such as charitable contributions or education expenses, can also play a significant role in tax planning. Overall, incorporating tax planning strategies into estate planning can ensure that individuals protect their assets and leave a lasting legacy for their loved ones.

Charitable giving

Charitable giving is an important aspect of estate planning that allows individuals to make a positive impact on their community and leave a lasting legacy. By including charitable donations in their estate plans, individuals can support causes and organizations that are meaningful to them, such as educational institutions, healthcare facilities, or environmental conservation efforts. Not only does charitable giving provide financial support to these organizations, but it also allows individuals to fulfill their philanthropic goals and create a positive change in the world. Whether it’s through donating assets, establishing a charitable foundation, or including charitable bequests in a will, incorporating charitable giving into an estate plan can provide individuals with a sense of fulfillment and purpose, knowing that their assets will continue to make a difference even after they are gone.

Estate Planning for Special Situations

Blended families

Blended families are becoming increasingly common in today’s society, and they often face unique challenges when it comes to estate planning. With multiple spouses, children from previous relationships, and stepchildren, it can be complex to ensure that everyone’s interests are protected. In these situations, it is crucial to work with an experienced estate planning attorney who can help navigate the intricacies of asset distribution, inheritance rights, and guardianship arrangements. By creating a comprehensive estate plan, blended families can ensure that their assets are distributed according to their wishes and that their loved ones are taken care of in the event of their passing.

Minor children

When it comes to estate planning, one important consideration is the well-being of minor children. It is crucial to establish a plan that ensures their financial security and guardianship in the event of your passing. This includes designating a guardian who will take care of their day-to-day needs and managing their inheritance until they reach adulthood. Additionally, setting up a trust can provide further protection for their assets and ensure they are used for their benefit in the long run. By addressing the needs of your minor children in your estate plan, you can have peace of mind knowing that their future is secure.

Incapacity planning

Incapacity planning is a crucial aspect of estate planning that involves making arrangements for the possibility of being unable to make decisions or manage one’s own affairs due to mental or physical incapacity. It is important to have a plan in place to ensure that your assets are protected and managed according to your wishes in the event of incapacity. This includes appointing a trusted individual or professional to act as your agent or power of attorney, who will make decisions on your behalf and handle your financial and healthcare matters. By engaging in incapacity planning, you can have peace of mind knowing that your assets and well-being will be safeguarded even if you are unable to make decisions for yourself.