Introduction

Understanding the role of insurance companies

Understanding the role of insurance companies is crucial for personal injury victims. Insurance companies play a significant role in the claims process, as they are responsible for compensating individuals who have suffered injuries due to the negligence of others. However, it is important to recognize that insurance companies are profit-driven entities, and their primary goal is to minimize payouts and protect their bottom line. This can often result in tactics such as delaying claims, undervaluing injuries, or denying legitimate claims altogether. Therefore, personal injury victims must be aware of the strategies employed by insurance companies and be prepared to advocate for their rights throughout the claims process.

Importance of dealing with insurance companies

When it comes to dealing with insurance companies as a personal injury victim, it is crucial to understand the importance of handling these interactions with care and diligence. Insurance companies are businesses that are primarily concerned with minimizing their financial liabilities, which means they may try to downplay the severity of your injuries or offer low settlement amounts. By recognizing the significance of dealing with insurance companies, you can take proactive steps to protect your rights and ensure you receive fair compensation for your injuries and damages. This involves gathering and preserving evidence, documenting your medical treatment and expenses, and seeking legal guidance if needed. Remember, the outcome of your claim can have a significant impact on your future, so it is essential to approach these interactions with the seriousness they deserve.

Overview of personal injury claims

An overview of personal injury claims provides a comprehensive understanding of the process that personal injury victims go through when dealing with insurance companies. It outlines the steps involved, such as filing a claim, gathering evidence, negotiating with the insurance company, and potentially going to court. This section serves as a guide for individuals who have suffered injuries due to someone else’s negligence and need to navigate the complex world of insurance claims. By understanding the overview of personal injury claims, victims can better prepare themselves and ensure they receive the compensation they deserve.

Choosing the Right Insurance Company

Researching insurance companies

When it comes to dealing with insurance companies as a personal injury victim, it is crucial to thoroughly research the insurance companies involved. This step is essential to ensure that you are working with reputable and reliable insurers who will provide fair compensation for your injuries. Start by gathering information about the insurance companies’ financial stability, customer satisfaction ratings, and claims handling practices. Look for any history of complaints or legal actions against the companies. Additionally, consider seeking recommendations from trusted sources, such as friends, family, or legal professionals, who have had experience dealing with insurance companies. By conducting thorough research, you can make informed decisions and increase your chances of receiving the compensation you deserve.

Evaluating coverage options

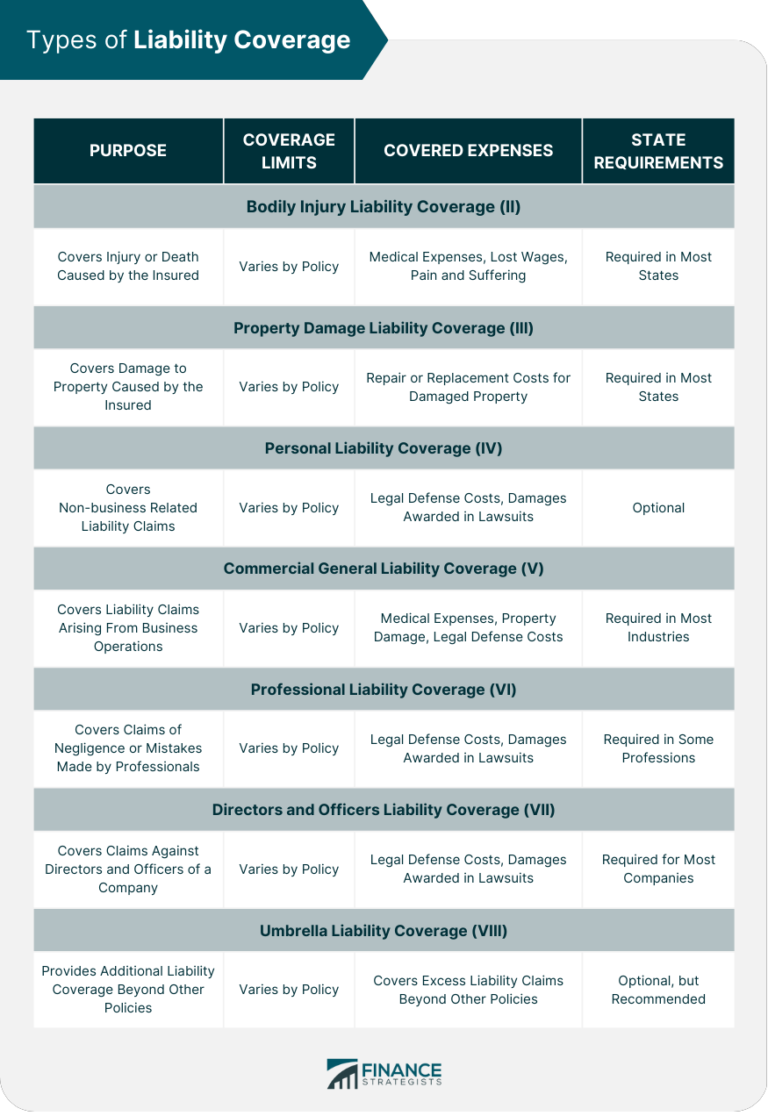

When evaluating coverage options with insurance companies, personal injury victims should consider several factors. First, it is important to review the policy details and understand the extent of coverage provided. This includes examining the limits of liability, deductibles, and any exclusions that may apply. Additionally, victims should assess the reputation and financial stability of the insurance company to ensure they can fulfill their obligations. It is also advisable to compare different coverage options from multiple insurers to find the most suitable one for their specific needs. Lastly, seeking professional advice from a personal injury attorney can be beneficial in navigating the complexities of insurance policies and negotiating fair settlements.

Considering customer reviews and ratings

When dealing with insurance companies as a personal injury victim, it is crucial to consider customer reviews and ratings. These reviews can provide valuable insights into the company’s reputation, customer satisfaction, and the overall quality of their services. By reading reviews and checking ratings, you can get an idea of how the insurance company has handled similar cases in the past and whether they have a track record of providing fair compensation. Additionally, customer reviews can also shed light on any potential red flags or warning signs to be aware of when working with a specific insurance company. Taking the time to research and consider customer reviews and ratings can help you make an informed decision and ensure that you are choosing an insurance company that will prioritize your needs and provide the support you require during this challenging time.

Filing a Claim

Gathering necessary documentation

When dealing with insurance companies as a personal injury victim, gathering necessary documentation is crucial. This includes medical records, police reports, photographs of the accident scene, and any other evidence that supports your claim. Insurance companies often require extensive documentation to process a claim, so it’s important to be thorough in collecting and organizing all relevant documents. By having all the necessary documentation, you can strengthen your case and increase the chances of a successful claim settlement.

Completing the claim form

When completing the claim form for your personal injury case, it is important to provide accurate and detailed information. Start by carefully reading the form and following any instructions provided. Make sure to include all relevant details about the incident, such as the date, time, and location. Describe the nature of your injuries and any medical treatment you have received. It is also important to include information about any witnesses or evidence that supports your claim. By providing thorough and accurate information on the claim form, you can help ensure a smooth and efficient process for your personal injury claim.

Submitting the claim

After gathering all the necessary documentation and evidence, the next step in dealing with insurance companies as a personal injury victim is submitting the claim. This is a crucial part of the process as it formally notifies the insurance company of your injuries and the damages you have suffered. When submitting the claim, it is important to be thorough and provide all relevant information, including medical records, witness statements, and any other supporting documents. Additionally, it is advisable to keep copies of all documents for your own records. It is also important to follow up with the insurance company to ensure that your claim is being processed and to address any questions or concerns they may have. By submitting a detailed and well-documented claim, you increase your chances of receiving fair compensation for your injuries and losses.

Negotiating with Insurance Adjusters

Understanding the role of insurance adjusters

Insurance adjusters play a crucial role in the personal injury claims process. They are representatives of the insurance companies and their primary responsibility is to investigate and evaluate the claims made by the victims. These adjusters are trained professionals who assess the extent of the injuries, gather evidence, and negotiate settlements on behalf of the insurance company. It is important for personal injury victims to understand the role of insurance adjusters as they will be the main point of contact throughout the claims process. By understanding their role, victims can better navigate the complexities of dealing with insurance companies and ensure they receive fair compensation for their injuries.

Preparing for negotiations

When preparing for negotiations with insurance companies as a personal injury victim, it is important to gather all relevant documentation and evidence to support your claim. This includes medical records, police reports, witness statements, and any other evidence that can strengthen your case. It is also crucial to understand the details of your insurance policy and the coverage you are entitled to. This knowledge will help you negotiate from a position of strength and ensure that you receive fair compensation for your injuries and damages. Additionally, it is advisable to consult with a personal injury attorney who specializes in dealing with insurance companies. They can provide invaluable guidance and representation throughout the negotiation process, ensuring that your rights are protected and that you receive the best possible outcome.

Tips for effective negotiation

When negotiating with insurance companies as a personal injury victim, it is important to be well-prepared and informed. Start by gathering all the necessary documentation and evidence to support your claim. This includes medical records, police reports, and any other relevant documents. It is also crucial to understand the value of your claim and have a clear idea of what you are seeking in terms of compensation. Additionally, it is recommended to consult with a personal injury attorney who can provide guidance and negotiate on your behalf. During the negotiation process, remain calm and composed, presenting your case with confidence and clarity. Be prepared to counter any lowball offers and provide strong arguments to support your desired settlement. Remember to keep all communication in writing and document every interaction with the insurance company. By following these tips, you can increase your chances of achieving a fair and satisfactory settlement with the insurance company.

Dealing with Denial or Delayed Claims

Understanding common reasons for denial or delay

Understanding common reasons for denial or delay is crucial for personal injury victims dealing with insurance companies. Insurance companies often deny or delay claims for various reasons, such as lack of sufficient evidence, disputes over liability, or policy exclusions. By understanding these common reasons, victims can better navigate the claims process and take necessary steps to ensure their rights are protected. It is important to gather all relevant documentation, including medical records, accident reports, and witness statements, to provide strong evidence to support the claim. Additionally, seeking legal advice from a personal injury attorney can help victims understand their rights and negotiate with insurance companies effectively. By being proactive and knowledgeable about the common reasons for denial or delay, personal injury victims can increase their chances of receiving fair compensation for their damages.

Appealing a denied claim

When your insurance claim is denied, it can be frustrating and disheartening. However, it’s important to remember that you have the right to appeal the decision. Appealing a denied claim involves gathering all relevant documentation, such as medical records and accident reports, to support your case. It’s also crucial to review your insurance policy and understand the specific reasons for the denial. Once you have all the necessary information, you can submit an appeal letter to the insurance company, outlining your arguments and providing evidence to support your claim. It’s important to be clear, concise, and persuasive in your appeal letter. Additionally, it may be helpful to consult with a personal injury attorney who can guide you through the appeals process and provide legal representation if necessary. Remember, appealing a denied claim requires patience and persistence, but it can ultimately result in a successful resolution of your insurance dispute.

Taking legal action for delayed claims

When dealing with insurance companies, one of the most frustrating situations for personal injury victims is the delay in claims processing. It can be incredibly disheartening to wait for months or even years for a resolution to your claim. However, there are steps you can take to take legal action for delayed claims. First, gather all the necessary documentation related to your injury, medical treatment, and the insurance claim. This includes medical records, bills, correspondence with the insurance company, and any other relevant evidence. Next, consult with a personal injury attorney who specializes in insurance claims. They can guide you through the legal process and help you understand your rights. Finally, file a lawsuit against the insurance company if necessary. This step should only be taken if all attempts to resolve the claim have been unsuccessful. Remember, taking legal action for delayed claims can be a complex and time-consuming process, but it may be necessary to ensure you receive the compensation you deserve.

Settling the Claim

Evaluating settlement offers

When evaluating settlement offers from insurance companies as a personal injury victim, it is crucial to carefully assess the terms and conditions of the proposed agreement. This involves thoroughly reviewing the amount being offered, the extent of coverage, and any potential limitations or exclusions. It is important to consult with a knowledgeable attorney who specializes in personal injury cases to ensure that the settlement offer adequately compensates for the injuries, damages, and losses suffered. Additionally, it is essential to consider the long-term implications of accepting a settlement, as it may impact future medical expenses or ongoing rehabilitation needs. By carefully evaluating settlement offers, personal injury victims can make informed decisions that protect their rights and maximize their compensation.

Negotiating a fair settlement

Negotiating a fair settlement with insurance companies is a crucial step for personal injury victims. It is important to approach this process with a clear understanding of your rights and the value of your claim. Start by gathering all necessary documentation, including medical records, bills, and evidence of the accident. Then, prepare a strong demand letter outlining the details of your case and the compensation you are seeking. During negotiations, be firm but reasonable, and consider seeking the assistance of a personal injury attorney if needed. Remember, the goal is to reach a fair settlement that adequately compensates you for your injuries and losses.

Finalizing the settlement agreement

Once all negotiations and discussions have taken place, it is time to finalize the settlement agreement. This crucial step ensures that both parties are in agreement and that the terms of the settlement are clearly defined. It is important to review the agreement carefully and seek legal advice if needed to ensure that your rights and interests are protected. Once the settlement agreement is finalized, it provides closure to the personal injury case, allowing you to move forward with your life and put the incident behind you.