Introduction

Understanding personal injury claims

Understanding personal injury claims is crucial when dealing with insurance companies. Personal injury claims involve seeking compensation for injuries sustained due to the negligence or wrongdoing of another party. It is important to understand the legal process and the various factors that can affect the outcome of a personal injury claim. This includes gathering evidence, assessing damages, negotiating with insurance adjusters, and potentially going to trial. By understanding the intricacies of personal injury claims, individuals can better navigate the insurance company’s tactics and work towards a fair settlement.

Importance of dealing with insurance companies

When it comes to personal injury claims, dealing with insurance companies is of utmost importance. Insurance companies play a significant role in the outcome of a claim, as they are responsible for providing compensation for injuries and damages. It is essential to understand the importance of effectively communicating and negotiating with insurance companies to ensure a fair settlement. Failing to do so can result in a lower settlement or even a denial of the claim. Therefore, it is crucial to approach insurance companies with the necessary knowledge and preparation to protect your rights and maximize your chances of receiving the compensation you deserve.

Overview of the article

In this article, we will provide an overview of the important aspects of dealing with insurance companies in personal injury claims. Insurance companies play a crucial role in the resolution of personal injury cases, as they are responsible for compensating the injured party. Understanding how insurance companies operate and the tactics they employ can greatly improve your chances of receiving fair compensation. We will discuss the claims process, common challenges faced by claimants, and strategies to effectively negotiate with insurance adjusters. By the end of this article, you will have a comprehensive understanding of the key considerations when dealing with insurance companies in personal injury claims.

Choosing the Right Insurance Company

Researching insurance companies

When it comes to personal injury claims, one of the key steps is researching insurance companies. It is important to gather information about the insurance company involved in the claim to understand their policies, coverage limits, and previous claim history. Researching insurance companies can help in determining the best approach for negotiating a settlement or pursuing legal action. By delving into their reputation, financial stability, and customer satisfaction ratings, individuals can make more informed decisions and effectively navigate the claims process. Additionally, researching insurance companies can also uncover any patterns of unfair practices or denial of valid claims, which can be crucial information when building a strong case. Overall, thorough research of insurance companies is essential in personal injury claims to ensure that individuals receive the compensation they deserve.

Checking the company’s reputation

When dealing with insurance companies in personal injury claims, it is crucial to check the company’s reputation. This step is essential to ensure that you are working with a reliable and trustworthy provider. Start by researching the company’s history, including its track record in handling claims and customer satisfaction ratings. Look for reviews and feedback from previous clients to get an idea of their experiences with the company. Additionally, consider checking if the insurance company is accredited by reputable industry organizations. By conducting thorough research on the company’s reputation, you can make an informed decision and have peace of mind throughout the claims process.

Evaluating coverage options

When evaluating coverage options in personal injury claims, it is important to carefully review the terms and conditions of the insurance policy. This includes understanding the types of coverage available, such as bodily injury liability, property damage liability, and medical payments coverage. It is also crucial to assess the limits of coverage and any exclusions that may apply. By thoroughly evaluating coverage options, individuals can make informed decisions and ensure they have adequate protection in the event of a personal injury claim.

Filing a Claim

Gathering necessary documentation

When dealing with insurance companies in personal injury claims, gathering necessary documentation is crucial. This includes medical records, police reports, witness statements, photographs of the accident scene, and any other evidence that supports your claim. By having all the necessary documentation, you can provide solid proof of your injuries and the extent of the damages you have suffered. This will greatly strengthen your case and increase the likelihood of a successful claim settlement. It is important to be organized and thorough in collecting all the required documentation to ensure a smooth and efficient claims process.

Completing the claim form

When completing the claim form for a personal injury claim, it is important to provide accurate and detailed information. Start by filling out your personal details, including your name, address, and contact information. Next, provide a clear and concise description of the incident, including the date, time, and location. Be sure to include any witnesses or evidence that may support your claim. It is also important to provide a detailed account of your injuries and the impact they have had on your daily life. This can include physical pain, emotional distress, and any financial losses you have incurred. Finally, make sure to review the form thoroughly before submitting it to ensure all information is accurate and complete. By completing the claim form accurately and thoroughly, you can increase your chances of a successful personal injury claim.

Submitting the claim

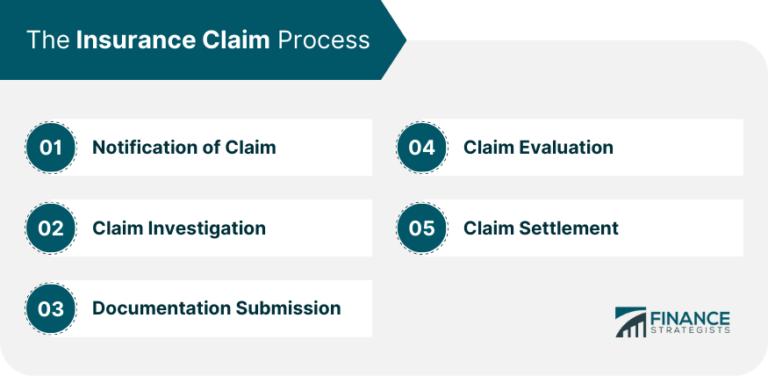

Submitting a claim to an insurance company is a crucial step in the personal injury claims process. It is important to gather all necessary documentation and evidence to support your claim, such as medical records, police reports, and witness statements. Once you have gathered all the necessary information, you can submit your claim to the insurance company. It is recommended to follow the specific instructions provided by the insurance company, as each company may have different procedures for submitting a claim. It is also important to keep copies of all documents and correspondence related to your claim for your records. By submitting the claim promptly and providing all necessary information, you increase the chances of a successful resolution of your personal injury claim.

Dealing with Insurance Adjusters

Understanding the role of insurance adjusters

Understanding the role of insurance adjusters is crucial when dealing with personal injury claims. Insurance adjusters are the representatives of insurance companies who assess the validity and value of claims. They play a significant role in the claims process, as they investigate the circumstances of the accident, gather evidence, and negotiate settlements. It is important to understand that insurance adjusters work for the insurance company and their primary goal is to protect the company’s interests. Therefore, it is essential for claimants to approach interactions with insurance adjusters with caution and be aware of their rights and entitlements. By understanding the role of insurance adjusters, claimants can navigate the claims process more effectively and ensure they receive fair compensation for their injuries and losses.

Communicating effectively with adjusters

When it comes to dealing with insurance companies in personal injury claims, effective communication with adjusters is crucial. Adjusters are the individuals responsible for evaluating and settling claims on behalf of the insurance company. To successfully navigate the claims process, it is important to establish clear and open lines of communication with adjusters. This involves providing them with all necessary documentation and information related to the claim, responding promptly to their inquiries, and maintaining a professional and respectful tone in all interactions. By effectively communicating with adjusters, you can ensure that your personal injury claim is handled efficiently and that you receive the compensation you deserve.

Negotiating a fair settlement

Negotiating a fair settlement is a crucial step in dealing with insurance companies in personal injury claims. It involves a careful and strategic approach to ensure that the injured party receives the compensation they deserve. During the negotiation process, it is important to gather and present strong evidence of the injuries sustained, the financial losses incurred, and the impact on the injured person’s quality of life. Additionally, understanding the insurance company’s policies and procedures can help navigate the negotiation process more effectively. It is advisable to seek legal representation to handle the negotiation on behalf of the injured party, as insurance companies often employ tactics to minimize the settlement amount. By having a skilled negotiator on their side, the injured party can increase their chances of achieving a fair and just settlement.

Handling Claim Denials

Understanding common reasons for claim denials

Understanding common reasons for claim denials is crucial when dealing with insurance companies in personal injury claims. Insurance companies often deny claims for various reasons, including lack of evidence, policy exclusions, pre-existing conditions, and disputed liability. It is important to thoroughly understand these common reasons to effectively navigate the claims process and increase the chances of a successful outcome. By being aware of potential claim denials, individuals can take proactive steps to strengthen their case and ensure they have the necessary documentation and support to counter any potential objections from the insurance company.

Appealing a denied claim

When your insurance claim is denied, it can be frustrating and overwhelming. However, appealing a denied claim is an important step in the personal injury claims process. To begin the appeal process, carefully review the denial letter from your insurance company to understand the reasons for the denial. It is crucial to gather all relevant documents and evidence to support your case. You may need to consult with a personal injury attorney who can guide you through the appeals process and help strengthen your claim. Additionally, be sure to meet all deadlines and requirements set by your insurance company for filing an appeal. By taking these steps, you can increase your chances of a successful appeal and ultimately receive the compensation you deserve.

Seeking legal assistance

Seeking legal assistance is crucial when dealing with insurance companies in personal injury claims. Insurance companies are known for their tactics to minimize payouts and protect their own interests. An experienced personal injury lawyer can navigate the complex legal process, negotiate with insurance adjusters, and ensure that you receive fair compensation for your injuries and damages. They have the knowledge and expertise to gather evidence, build a strong case, and advocate for your rights. By hiring a lawyer, you can level the playing field and increase your chances of a successful outcome in your personal injury claim.

Settling the Claim

Evaluating settlement offers

When evaluating settlement offers in personal injury claims, it is important to carefully consider various factors. Firstly, the extent of the injuries and the impact they have had on the victim’s life should be taken into account. This includes physical pain and suffering, emotional trauma, and any resulting disabilities or limitations. Additionally, the financial losses incurred as a result of the accident, such as medical expenses, lost wages, and property damage, should be thoroughly assessed. Furthermore, it is crucial to review the strength of the evidence and the likelihood of success if the case were to go to trial. By weighing these factors, individuals can make informed decisions and negotiate fair settlement agreements with insurance companies.

Negotiating the final settlement

Negotiating the final settlement is a crucial step in the process of dealing with insurance companies in personal injury claims. After going through the arduous journey of filing a claim, gathering evidence, and negotiating with the insurance adjuster, reaching a fair and satisfactory settlement is the ultimate goal. During this stage, it is important to have a clear understanding of the value of your claim and to effectively communicate your demands. Skilled negotiation tactics, such as presenting strong evidence, highlighting the impact of the injury on your life, and being persistent, can significantly increase your chances of securing a favorable settlement. It is also advisable to seek professional legal advice to navigate the complexities of the negotiation process and ensure that you are not taken advantage of by the insurance company. By staying informed, assertive, and patient, you can maximize your chances of achieving a fair and just settlement that adequately compensates you for your injuries and losses.

Signing the settlement agreement

When it comes to signing the settlement agreement in personal injury claims, it is crucial to proceed with caution. This document is a legally binding contract that outlines the terms and conditions of the settlement. Before signing, it is important to carefully review the agreement and seek legal advice if needed. Ensure that all the terms are fair and reasonable, and that you fully understand the implications of signing. Once you sign the settlement agreement, you may be waiving your right to pursue further legal action. Therefore, take the time to consider all the factors and consult with your attorney before making a final decision.