Introduction

Understanding personal injury claims

Understanding personal injury claims is essential when dealing with insurance companies. Personal injury claims arise when an individual suffers physical or psychological harm due to the negligence or wrongdoing of another party. These claims can include car accidents, slip and falls, medical malpractice, and more. It is important to understand the legal process involved in personal injury claims, including gathering evidence, filing a claim, negotiating with insurance adjusters, and potentially pursuing a lawsuit if necessary. By understanding the intricacies of personal injury claims, individuals can better navigate the insurance company’s tactics and ensure they receive fair compensation for their injuries and losses.

Importance of dealing with insurance companies

Dealing with insurance companies is of utmost importance in a personal injury claim. Insurance companies play a crucial role in the resolution of these claims, as they are responsible for providing compensation to injured individuals. It is essential to understand the importance of effectively communicating and negotiating with insurance companies to ensure a fair and just settlement. Failing to properly deal with insurance companies can result in delays, denials, or inadequate compensation. Therefore, it is crucial to be well-prepared, knowledgeable, and assertive when dealing with insurance companies in a personal injury claim.

Overview of the article

In this article, we will provide an overview of the key points to consider when dealing with insurance companies in a personal injury claim. We will discuss the importance of understanding your rights and the insurance company’s obligations, as well as the steps involved in filing a claim. Additionally, we will explore common tactics used by insurance companies to minimize payouts and provide tips on how to navigate through the claims process. By the end of this article, you will have a better understanding of how to effectively handle interactions with insurance companies and maximize your chances of receiving fair compensation for your personal injury.

Finding the Right Insurance Company

Researching insurance companies

When it comes to filing a personal injury claim, one of the crucial steps is researching insurance companies. It is important to gather information about the insurance company involved in the case, such as their reputation, financial stability, and previous track record in handling similar claims. Researching insurance companies can provide valuable insights into their policies, practices, and potential tactics they may use during the claims process. By conducting thorough research, claimants can be better prepared to negotiate with insurance companies and ensure they receive fair compensation for their injuries and damages.

Checking the company’s reputation

When dealing with insurance companies in a personal injury claim, it is essential to check the company’s reputation. This step is crucial as it helps you determine the credibility and reliability of the insurance provider. By researching the company’s track record, customer reviews, and financial stability, you can gain valuable insights into their ability to handle claims efficiently and fairly. A reputable insurance company will have a strong reputation for prompt and fair settlements, providing you with the confidence that your claim will be handled professionally. It is advisable to consult independent sources, such as consumer advocacy websites or state insurance departments, to gather information about the company’s reputation. By checking the company’s reputation, you can make an informed decision and ensure that your personal injury claim is in good hands.

Evaluating coverage options

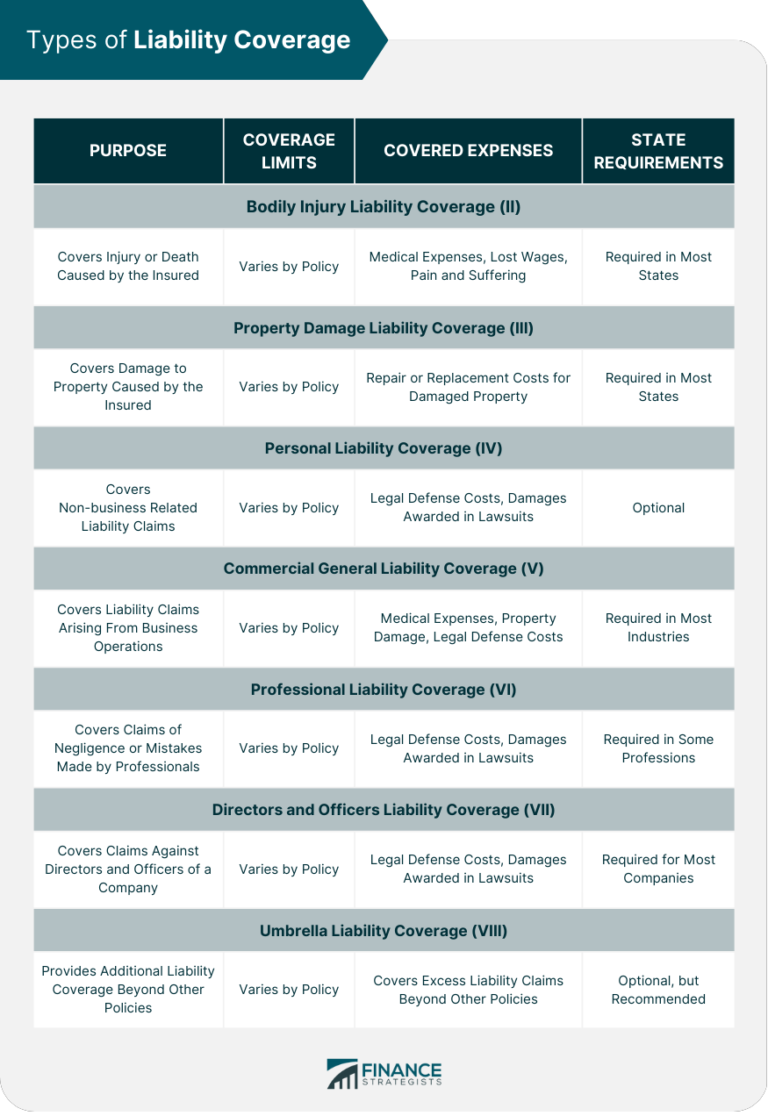

When evaluating coverage options in a personal injury claim, it is important to carefully review the terms and conditions of your insurance policy. This will help you determine the extent of coverage available to you and what types of injuries and damages are covered. Additionally, it is crucial to assess the limits of your coverage, including any deductibles or out-of-pocket expenses that may apply. Understanding your coverage options will allow you to make informed decisions when dealing with insurance companies and negotiating a fair settlement for your personal injury claim.

Filing a Claim

Gathering necessary documents

When dealing with insurance companies in a personal injury claim, gathering necessary documents is essential. These documents serve as evidence to support your claim and provide a clear picture of the incident. Some of the documents you may need to gather include medical records, police reports, witness statements, and any relevant photographs or videos. It is important to collect these documents as soon as possible to ensure that no crucial evidence is lost or forgotten. By having all the necessary documents in hand, you can effectively communicate your case to the insurance company and increase your chances of a successful claim settlement.

Completing the claim form

Completing the claim form is a crucial step in the process of dealing with insurance companies in a personal injury claim. This document serves as the official record of the incident and provides the necessary information for the insurance company to evaluate the claim. When completing the claim form, it is important to provide accurate and detailed information about the accident, injuries sustained, and any medical treatment received. This includes documenting the date, time, and location of the incident, as well as the names and contact information of any witnesses. Additionally, it is essential to include any supporting documentation, such as medical records, police reports, and photographs, to strengthen the validity of the claim. By carefully completing the claim form, individuals can ensure that all relevant information is provided, increasing the likelihood of a successful personal injury claim.

Submitting the claim

After gathering all the necessary documentation and evidence, the next step in dealing with insurance companies in a personal injury claim is to submit the claim. This involves contacting the insurance company and providing them with all the relevant information about the accident, injuries sustained, and any medical treatment received. It is important to be thorough and accurate when filling out the claim forms, as any missing or incorrect information could delay the processing of the claim. Additionally, it is advisable to keep copies of all documents submitted and to follow up with the insurance company to ensure that the claim is being processed in a timely manner.

Negotiating with Insurance Adjusters

Understanding the role of insurance adjusters

Understanding the role of insurance adjusters is crucial when dealing with insurance companies in a personal injury claim. Insurance adjusters are the individuals responsible for evaluating and negotiating the settlement of a claim on behalf of the insurance company. They play a significant role in the claims process as they assess the extent of the damages, gather evidence, and determine the compensation that should be paid to the injured party. It is important to understand that insurance adjusters work for the insurance company and their primary goal is to minimize the amount of money the company has to pay out. Therefore, it is essential for claimants to be prepared, knowledgeable, and assertive when dealing with insurance adjusters. By understanding their role and being proactive in the negotiation process, claimants can increase their chances of receiving a fair and just settlement for their personal injury claim.

Preparing for negotiations

Preparing for negotiations is a crucial step in dealing with insurance companies in a personal injury claim. It is important to be well-prepared and knowledgeable about the details of your claim before entering into negotiations. This includes gathering all relevant documentation, such as medical records, police reports, and any other evidence that supports your case. Additionally, it is helpful to have a clear understanding of the insurance company’s policies and procedures, as well as any applicable laws and regulations. By being prepared, you can approach negotiations with confidence and increase your chances of achieving a fair settlement.

Tips for effective negotiation

When it comes to negotiating with insurance companies in a personal injury claim, there are several tips that can help you achieve a more effective outcome. First and foremost, it is important to gather all the necessary documentation and evidence to support your claim. This includes medical records, police reports, and any other relevant information. Additionally, it is crucial to understand the value of your claim and have a clear idea of what you are seeking in terms of compensation. It is also advisable to consult with a personal injury attorney who can provide guidance and negotiate on your behalf. During the negotiation process, it is important to remain calm and composed, presenting your case in a clear and concise manner. Being prepared to counter any arguments or tactics used by the insurance company is also essential. Finally, it is important to be patient and persistent throughout the negotiation process, as it may take time to reach a fair settlement. By following these tips, you can increase your chances of achieving a favorable outcome in your personal injury claim.

Dealing with Denial or Delayed Claims

Reasons for denial or delay

One of the main challenges in a personal injury claim is dealing with insurance companies. Unfortunately, insurance companies often deny or delay claims for various reasons. One of the reasons for denial or delay is the insurance company’s skepticism about the severity of the injury. They may argue that the injury is not as serious as claimed or that it was pre-existing. Another reason could be the lack of sufficient evidence to support the claim. Insurance companies may require extensive documentation and proof of the accident and injuries sustained. Additionally, insurance companies may also deny or delay claims due to policy exclusions or limitations. It is important for claimants to be aware of these potential reasons for denial or delay and to be prepared to provide strong evidence to support their claim.

Appealing a denied claim

When your insurance claim is denied, it can be frustrating and disheartening. However, it’s important to remember that you have the right to appeal the decision. To start the appeals process, gather all relevant documentation, such as medical records, police reports, and any correspondence with the insurance company. Review your policy carefully to understand the reasons for denial and any specific requirements for appeals. It may be helpful to consult with a personal injury attorney who can guide you through the process and help build a strong case. Remember to stay organized, keep track of all communication, and be persistent in pursuing your appeal. With determination and the right support, you can increase your chances of overturning a denied claim and obtaining the compensation you deserve.

Taking legal action

Taking legal action in a personal injury claim is a crucial step towards seeking the compensation you deserve. When dealing with insurance companies, it is important to understand that they are primarily focused on protecting their own interests. Therefore, if negotiations with the insurance company fail to result in a fair settlement, taking legal action may be necessary. This involves filing a lawsuit against the responsible party and presenting your case in court. By doing so, you can demonstrate the extent of your injuries, the impact they have had on your life, and the financial losses you have incurred. Taking legal action can be a complex process, but with the help of an experienced personal injury attorney, you can navigate the legal system and increase your chances of obtaining a favorable outcome.

Settlement and Compensation

Understanding settlement offers

Understanding settlement offers is a crucial aspect of dealing with insurance companies in a personal injury claim. When an insurance company makes a settlement offer, it is important to carefully evaluate the terms and consider the potential benefits and drawbacks. It is essential to understand that the initial offer may not always be fair or sufficient to cover all the damages and losses incurred. Therefore, it is advisable to consult with a personal injury attorney who can provide expert guidance and negotiate on your behalf to ensure a fair settlement. By understanding settlement offers, individuals can make informed decisions and protect their rights in the personal injury claim process.

Negotiating a fair compensation

When negotiating a fair compensation with insurance companies in a personal injury claim, it is important to be well-prepared and informed. Start by gathering all the necessary documentation related to your injury, medical bills, and lost wages. This will help you present a strong case and provide evidence of the damages you have suffered. It is also crucial to understand the full extent of your injuries and their long-term impact on your life. This knowledge will enable you to accurately assess the value of your claim and negotiate from a position of strength. Additionally, it is advisable to seek legal representation from an experienced personal injury attorney who can guide you through the negotiation process and advocate for your best interests. Remember, negotiating with insurance companies can be challenging, but with the right preparation and support, you can increase your chances of obtaining a fair and just compensation.

Finalizing the settlement

After all the negotiations and discussions, the final step in dealing with insurance companies in a personal injury claim is finalizing the settlement. This is the moment when all parties involved reach an agreement on the compensation amount and the terms of the settlement. It is crucial to carefully review all the details of the settlement before signing any documents. Once the settlement is finalized, the insurance company will issue the payment, and the claim will be officially closed. It is important to consult with a legal professional throughout this process to ensure that your rights are protected and that you receive fair compensation for your injuries and damages.