Introduction

Definition of personal injury lawsuits

A personal injury lawsuit is a legal action taken by an individual who has suffered physical or psychological harm as a result of someone else’s negligence or intentional wrongdoing. In these cases, the injured party seeks compensation for their losses, including medical expenses, lost wages, pain and suffering, and other damages. Personal injury lawsuits are typically filed against the responsible party’s insurance company or directly against the individual or entity responsible for the injury. These lawsuits aim to hold the negligent party accountable for their actions and provide the injured party with the financial support they need to recover and move forward.

Definition of insurance claims

Insurance claims refer to the process of seeking compensation from an insurance company for a loss or damage covered by an insurance policy. When an individual or business experiences an event that leads to financial loss, such as a car accident or property damage, they can file an insurance claim to recover the costs associated with the incident. Insurance claims involve submitting documentation, such as police reports, medical records, or repair estimates, to support the claim and provide evidence of the loss. Once the claim is filed, the insurance company will review the information and determine the amount of compensation to be awarded, based on the terms and conditions of the policy. The goal of an insurance claim is to help policyholders recover financially from unexpected events and mitigate the impact of the loss.

Purpose of the article

The purpose of this article is to provide a comprehensive comparison between personal injury lawsuits and insurance claims. It aims to highlight the key differences and similarities between these two legal avenues for seeking compensation in the event of an accident or injury. By examining the advantages and disadvantages of each option, readers will gain a better understanding of which approach may be most suitable for their specific circumstances. Whether you are considering filing a lawsuit or making an insurance claim, this article will serve as a valuable resource to help you make an informed decision.

Differences in Process

Filing a personal injury lawsuit

Filing a personal injury lawsuit is a legal process that allows individuals who have been injured due to someone else’s negligence or wrongdoing to seek compensation for their damages. In order to file a personal injury lawsuit, the injured party, also known as the plaintiff, must gather evidence to support their claim, such as medical records, witness statements, and documentation of any financial losses incurred as a result of the injury. Once the necessary evidence has been collected, the plaintiff can then proceed to file a formal complaint with the appropriate court. It is important to note that filing a personal injury lawsuit requires a thorough understanding of the legal system and the specific laws governing personal injury cases, which is why it is often advisable to seek the assistance of an experienced personal injury attorney.

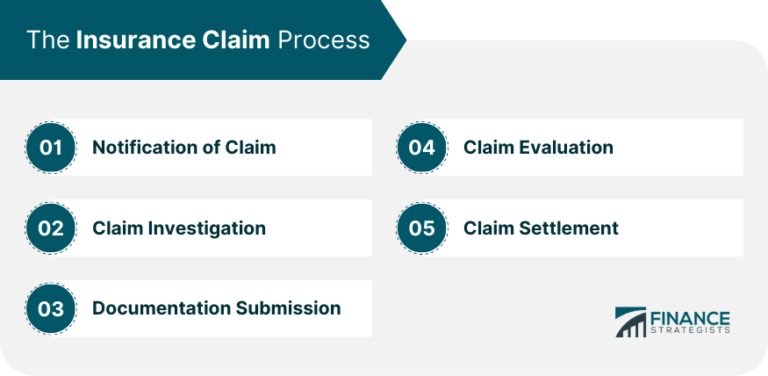

Filing an insurance claim

Filing an insurance claim is an important step to take after sustaining a personal injury. When filing an insurance claim, individuals seek compensation from their insurance provider for the damages and losses they have suffered. This process involves providing detailed information about the incident, such as the date, time, and location of the accident, as well as any evidence or documentation that supports the claim. It is crucial to accurately and thoroughly complete the necessary forms and submit them within the specified timeframe. By filing an insurance claim, individuals can potentially receive financial assistance to cover medical expenses, property damage, and other costs incurred as a result of the personal injury.

Role of legal representation

The role of legal representation is crucial when it comes to personal injury lawsuits and insurance claims. A skilled and experienced attorney can navigate the complex legal system and ensure that the rights of the injured party are protected. In personal injury lawsuits, a lawyer will gather evidence, interview witnesses, and negotiate with insurance companies to secure a fair settlement. They will also represent the injured party in court if the case goes to trial. Similarly, in insurance claims, an attorney can help in dealing with the insurance company and ensure that the injured party receives the compensation they deserve. With their expertise and knowledge of the law, legal representation plays a vital role in maximizing the chances of a successful outcome in both personal injury lawsuits and insurance claims.

Compensation

Types of compensation in personal injury lawsuits

In personal injury lawsuits, there are various types of compensation that can be awarded to the injured party. These compensations are designed to help the victim recover from their injuries and regain their quality of life. The types of compensation commonly sought in personal injury lawsuits include medical expenses, lost wages, pain and suffering, and property damage. Medical expenses cover the cost of medical treatment, rehabilitation, and any future medical needs resulting from the injury. Lost wages compensate the injured party for the income they have lost due to their inability to work. Pain and suffering damages are awarded to compensate for the physical and emotional pain caused by the injury. Lastly, property damage compensation is provided to cover any damage to the victim’s property as a result of the incident. Each of these types of compensation aims to provide the injured party with the financial support needed to recover and move forward after an accident or injury.

Types of compensation in insurance claims

In insurance claims, there are various types of compensation that individuals can seek. These types of compensation may include medical expenses, lost wages, property damage, pain and suffering, and emotional distress. Medical expenses cover the costs of any necessary medical treatments, including hospital stays, surgeries, medications, and rehabilitation. Lost wages compensate individuals for any income they have lost due to their injury, including both past and future earnings. Property damage covers the costs of repairing or replacing any damaged property, such as a vehicle. Pain and suffering compensation is awarded for the physical and emotional pain endured as a result of the injury, while emotional distress compensation is provided for any psychological harm caused by the incident. Understanding the different types of compensation available in insurance claims can help individuals navigate the claims process and ensure they receive the appropriate compensation for their injuries.

Factors affecting compensation

Factors affecting compensation in personal injury lawsuits and insurance claims can vary depending on several key factors. One of the main factors is the severity of the injury sustained by the victim. Generally, the more severe the injury, the higher the potential compensation. Another important factor is the extent of the victim’s medical expenses and treatment. The cost of medical care, rehabilitation, and ongoing therapy can significantly impact the compensation amount. Additionally, the impact of the injury on the victim’s daily life and ability to work may also be considered. If the injury has resulted in a loss of income or diminished earning capacity, the compensation may be adjusted accordingly. Other factors that can affect compensation include the negligence or fault of the parties involved, the jurisdiction in which the lawsuit or claim is filed, and any applicable insurance policies or coverage limits. It is crucial to consult with an experienced personal injury attorney or insurance claims adjuster to fully understand the specific factors that may influence the compensation in a particular case.

Timeframe

Length of personal injury lawsuits

The length of personal injury lawsuits can vary significantly depending on various factors. One of the main factors that contribute to the duration of a personal injury lawsuit is the complexity of the case. If the case involves multiple parties, extensive damages, or intricate legal issues, it is likely to take longer to reach a resolution. Additionally, the court’s schedule, the availability of witnesses, and the efficiency of the legal process can also impact the length of the lawsuit. On average, personal injury lawsuits can take several months to several years to conclude. It is important for individuals involved in such lawsuits to have patience and be prepared for a potentially lengthy legal process.

Length of insurance claims

The length of insurance claims can vary depending on several factors. One of the main factors is the complexity of the case. If the case involves multiple parties or extensive damages, it can take longer to resolve. Additionally, the efficiency of the insurance company and their claims process can also impact the length of the claim. Some insurance companies may have streamlined processes and dedicated teams that can expedite the claim, while others may have slower response times. Another factor to consider is any potential disputes or negotiations that may arise during the claims process. If there are disagreements between the insured and the insurance company regarding coverage or settlement amounts, it can prolong the process. Overall, the length of insurance claims can vary significantly and it is important for individuals to be aware of the potential timeframes when filing a claim.

Factors affecting timeframe

Factors affecting the timeframe of personal injury lawsuits and insurance claims can vary depending on several key factors. One such factor is the complexity of the case. If a personal injury case involves multiple parties, extensive documentation, or intricate legal issues, it may take longer to reach a resolution. Additionally, the availability of evidence and the cooperation of all parties involved can also impact the timeframe. Furthermore, the jurisdiction in which the lawsuit or claim is filed can influence the length of the process, as different courts may have varying caseloads and procedures. Lastly, the willingness of the parties to negotiate and reach a settlement can significantly expedite or prolong the timeframe. Therefore, it is crucial for individuals involved in personal injury lawsuits or insurance claims to consider these factors when assessing the expected duration of their case.

Burden of Proof

Burden of proof in personal injury lawsuits

In personal injury lawsuits, the burden of proof lies with the plaintiff. This means that the injured party must provide sufficient evidence to show that the defendant was negligent and that their negligence directly caused the injuries. The burden of proof is a crucial aspect of personal injury cases because it determines whether the plaintiff will be successful in their claim. To meet the burden of proof, the plaintiff must present credible evidence, such as medical records, eyewitness testimonies, and expert opinions, to convince the court that their version of events is more likely than not. The burden of proof in personal injury lawsuits can be challenging, as it requires the plaintiff to gather and present compelling evidence to support their case.

Burden of proof in insurance claims

In insurance claims, the burden of proof lies with the policyholder. This means that the policyholder is responsible for providing evidence to support their claim and prove that the incident or accident is covered by their insurance policy. The burden of proof can be a challenging task as it requires gathering all the necessary documentation, such as medical records, police reports, and witness statements, to present a strong case to the insurance company. It is important for policyholders to understand the burden of proof and the level of evidence required to successfully file an insurance claim.

Standard of proof

In personal injury lawsuits, the standard of proof is typically higher than in insurance claims. In a lawsuit, the plaintiff must provide evidence that proves the defendant’s negligence or fault beyond a reasonable doubt. This means that the plaintiff must present a convincing case with strong evidence to convince the judge or jury of the defendant’s liability. On the other hand, in an insurance claim, the burden of proof is usually lower. The claimant must show that it is more likely than not that the defendant is responsible for the injury or damages. This difference in the standard of proof can significantly impact the outcome and compensation in personal injury cases.

Conclusion

Summary of key differences

In summary, there are several key differences between personal injury lawsuits and insurance claims. Firstly, the parties involved differ. In a personal injury lawsuit, the injured party files a lawsuit against the at-fault party, seeking compensation for their injuries. On the other hand, an insurance claim is filed with the insurance company, seeking compensation for damages covered by the policy. Secondly, the burden of proof varies. In a personal injury lawsuit, the injured party must prove that the at-fault party’s negligence caused their injuries. In an insurance claim, the policyholder must provide evidence of the damages and their coverage under the policy. Finally, the potential compensation differs. In a personal injury lawsuit, the injured party may be awarded damages for medical expenses, lost wages, pain and suffering, and more. In an insurance claim, the compensation is typically limited to the coverage provided by the policy. Overall, understanding these key differences is crucial when deciding whether to pursue a personal injury lawsuit or file an insurance claim.

Considerations when choosing between a lawsuit and an insurance claim

When deciding between filing a personal injury lawsuit or making an insurance claim, there are several important considerations to keep in mind. One of the main factors to consider is the potential compensation you may receive. While insurance claims typically offer a quicker resolution, they may not provide the full amount of compensation you deserve. On the other hand, personal injury lawsuits can potentially result in higher payouts, but they also involve a longer and more complex legal process. Additionally, the strength of your case and the evidence available should be taken into account. If you have strong evidence and a solid case, pursuing a lawsuit may be a viable option. However, if the evidence is weak or insufficient, an insurance claim may be a more practical choice. Finally, it is important to consider the time and resources required for each option. Lawsuits can be time-consuming and expensive, while insurance claims are generally faster and less costly. Ultimately, the decision between a lawsuit and an insurance claim should be based on a careful evaluation of these considerations and your individual circumstances.

Final thoughts

In conclusion, when it comes to personal injury cases, both lawsuits and insurance claims have their advantages and disadvantages. Lawsuits provide the opportunity for victims to seek full compensation for their injuries, but they can be time-consuming, expensive, and emotionally draining. On the other hand, insurance claims offer a quicker and less stressful process, but the compensation may be limited. Ultimately, the choice between a lawsuit and an insurance claim depends on the specific circumstances of the case and the goals of the victim. It is important to consult with a personal injury attorney to determine the best course of action and ensure that your rights are protected.