Introduction

Definition of small business

A small business is generally defined as a privately owned company that has a limited number of employees and generates a relatively low volume of revenue. The exact definition of a small business can vary depending on the industry and country. In most cases, small businesses are characterized by their ability to adapt quickly to market changes, their focus on providing personalized services, and their contribution to the local economy. Small business owners face unique legal challenges and should be aware of common legal issues that can arise, such as intellectual property protection, contract disputes, and compliance with employment laws.

Importance of legal knowledge for small business owners

Having a solid understanding of legal issues is crucial for small business owners. It allows them to navigate the complex world of business regulations and avoid potential legal pitfalls. By having legal knowledge, small business owners can ensure compliance with laws and regulations, protect their business and assets, and minimize the risk of lawsuits. Additionally, understanding legal issues gives small business owners the confidence to make informed decisions and negotiate contracts effectively. Without proper legal knowledge, small business owners may face costly legal disputes and jeopardize the success of their business. Therefore, it is essential for small business owners to prioritize gaining legal knowledge and seeking professional advice when needed.

Overview of common legal issues

As a small business owner, it is crucial to have a good understanding of the common legal issues that can arise in the course of running your business. These legal issues can have a significant impact on your business operations, finances, and reputation. By being aware of these issues, you can take proactive steps to mitigate risks and ensure compliance with the law. In this article, we will provide an overview of some of the most common legal issues that small business owners should be familiar with, including intellectual property rights, contracts, employment laws, and regulatory compliance. Understanding these legal issues will help you navigate the complex legal landscape and protect your business from potential legal disputes and liabilities.

Business Formation

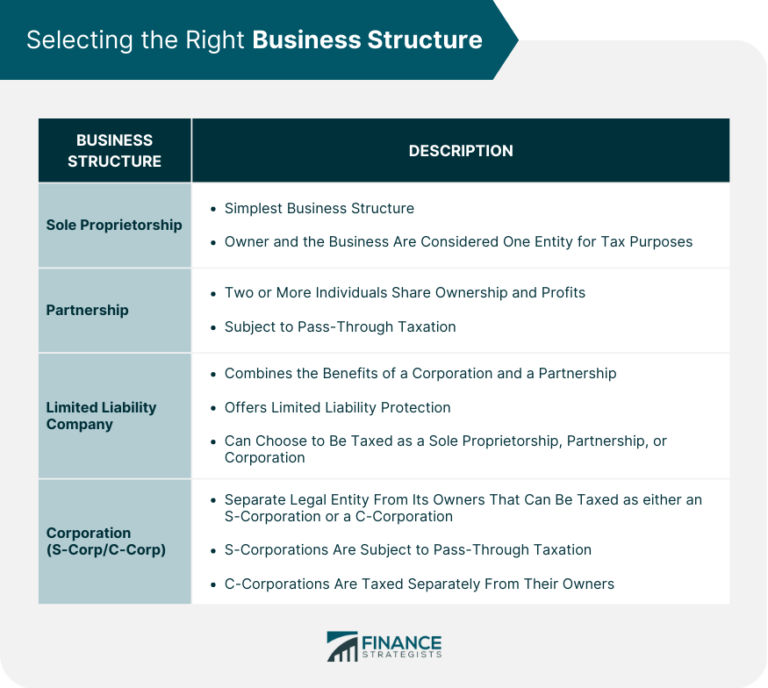

Choosing the right legal structure

Choosing the right legal structure is a crucial decision for every small business owner. The legal structure you choose will have a significant impact on various aspects of your business, including taxation, liability, and ownership. There are several options to consider, such as sole proprietorship, partnership, limited liability company (LLC), and corporation. Each legal structure has its own advantages and disadvantages, so it is important to carefully evaluate your business goals and requirements before making a decision. Consulting with a legal professional can help you navigate through the complexities and make an informed choice that suits your specific needs.

Registering the business

When it comes to starting a small business, one of the most important steps is registering the business. Registering a business is necessary to establish its legal identity and protect the owner’s personal assets. It involves choosing a business name, determining the business structure, and obtaining the necessary licenses and permits. Registering the business also allows the owner to open a business bank account, apply for business loans, and enter into contracts. It is essential for small business owners to understand the process and requirements for registering their business to ensure compliance with the law and set a strong foundation for success.

Obtaining necessary licenses and permits

When starting a small business, it is crucial for owners to understand the importance of obtaining necessary licenses and permits. These legal documents are required by local, state, and federal governments to ensure compliance with regulations and laws. Failure to obtain the appropriate licenses and permits can result in fines, penalties, and even the closure of the business. Small business owners should research and identify the specific licenses and permits needed for their industry and location. This may include permits for zoning, health and safety, professional certifications, and sales tax. By proactively obtaining the necessary licenses and permits, small business owners can operate legally and avoid potential legal issues in the future.

Contracts and Agreements

Understanding the basics of contracts

Contracts are an essential part of running a small business. Understanding the basics of contracts is crucial for every small business owner. A contract is a legally binding agreement between two or more parties that outlines the rights and obligations of each party. It is important to carefully review and understand the terms and conditions of a contract before signing it. This includes being aware of any potential risks or liabilities that may arise from the contract. By understanding the basics of contracts, small business owners can protect their interests and minimize the chances of legal disputes or issues.

Drafting and negotiating contracts

Drafting and negotiating contracts is a crucial aspect of running a small business. It involves creating legally binding agreements that protect the interests of both parties involved. A well-drafted contract can help prevent misunderstandings and disputes, ensuring that all parties are clear on their rights and obligations. Additionally, effective negotiation skills are essential in securing favorable terms and conditions that align with the business’s objectives. Small business owners should be familiar with the key elements of contract drafting and negotiation to mitigate potential legal risks and maximize their business’s success.

Enforcing contracts and resolving disputes

Enforcing contracts and resolving disputes is a crucial aspect of running a small business. Small business owners should be aware of the legal issues that can arise when it comes to enforcing contracts and resolving disputes with clients, suppliers, or employees. It is important to have well-drafted contracts in place to protect the interests of the business and ensure that both parties are held accountable for their obligations. In the event of a dispute, small business owners should consider alternative dispute resolution methods, such as mediation or arbitration, to avoid costly and time-consuming litigation. By understanding and addressing these common legal issues, small business owners can minimize the risk of legal disputes and maintain a positive and productive working environment.

Intellectual Property

Protecting trademarks and copyrights

Protecting trademarks and copyrights is crucial for small business owners to safeguard their intellectual property. Trademarks help businesses establish brand identity and prevent others from using similar names or logos, while copyrights protect original creative works such as literary, artistic, or musical creations. By registering trademarks and copyrights, small business owners can take legal action against anyone who infringes on their intellectual property rights. Additionally, implementing proper licensing agreements and monitoring the market for potential infringements can further protect their trademarks and copyrights. Overall, understanding and actively protecting trademarks and copyrights is essential for small business owners to maintain their competitive advantage and preserve the value of their intellectual assets.

Registering patents

Registering patents is a crucial step for small business owners to protect their intellectual property. By registering a patent, entrepreneurs can secure exclusive rights to their inventions, preventing others from copying or using their ideas without permission. This not only safeguards their innovative products or processes but also provides a competitive advantage in the market. Additionally, having a registered patent can attract potential investors and increase the value of the business. However, navigating the patent registration process can be complex and time-consuming, requiring thorough research, documentation, and legal expertise. Therefore, it is essential for small business owners to seek professional guidance to ensure a smooth and successful patent registration process.

Dealing with intellectual property infringement

Dealing with intellectual property infringement is a critical concern for small business owners. In today’s highly competitive and digital world, protecting one’s intellectual property rights is essential to maintain a competitive edge and prevent unauthorized use of valuable assets. Whether it’s trademarks, copyrights, patents, or trade secrets, small business owners must be vigilant in identifying and addressing any potential infringement. This may involve conducting thorough research to ensure that their intellectual property is not being used without permission, monitoring the market for any signs of infringement, and taking appropriate legal action when necessary. By proactively dealing with intellectual property infringement, small business owners can safeguard their creativity, innovation, and brand identity, ensuring long-term success and growth.

Employment Law

Hiring employees vs. independent contractors

When it comes to hiring employees vs. independent contractors, small business owners need to be aware of the legal implications. Hiring employees means taking on certain responsibilities, such as paying payroll taxes, providing benefits, and complying with labor laws. On the other hand, hiring independent contractors can offer more flexibility and cost savings, but it’s important to ensure that the relationship meets the criteria set by the IRS to avoid misclassification. Small business owners should consult with legal professionals to understand the legal requirements and make informed decisions when it comes to hiring employees or independent contractors.

Understanding employee rights and obligations

Understanding employee rights and obligations is crucial for every small business owner. As an employer, it is important to be aware of the legal framework that governs the relationship between the business and its employees. This includes understanding laws related to minimum wage, working hours, overtime, and discrimination. By understanding these rights and obligations, small business owners can ensure that they are providing a fair and safe working environment for their employees while also avoiding potential legal issues.

Complying with employment laws and regulations

Complying with employment laws and regulations is crucial for every small business owner. By understanding and adhering to these laws, business owners can protect themselves from potential legal disputes and financial penalties. It is important to stay up-to-date with the latest employment laws, such as minimum wage requirements, overtime regulations, and anti-discrimination policies. Additionally, small business owners should establish clear and comprehensive employment contracts, maintain accurate records, and provide a safe and inclusive work environment for their employees. By prioritizing compliance with employment laws, small business owners can foster a positive and legally sound workplace.

Taxation and Compliance

Understanding tax obligations for small businesses

Understanding tax obligations for small businesses is crucial for every small business owner. Taxes play a significant role in the financial management of a business, and failure to comply with tax obligations can lead to serious consequences. Small business owners need to understand their tax responsibilities, such as filing tax returns, paying taxes on time, and keeping accurate financial records. Additionally, they should be aware of any tax deductions or credits that they may be eligible for, which can help reduce their tax liability. By understanding and fulfilling their tax obligations, small business owners can ensure compliance with the law and avoid unnecessary penalties or legal issues.

Maintaining proper financial records

Maintaining proper financial records is crucial for every small business owner. It allows them to track their income and expenses accurately, which is essential for making informed financial decisions. By keeping detailed records, business owners can also ensure compliance with tax regulations and easily provide documentation in case of audits or legal disputes. Additionally, maintaining proper financial records enables small business owners to evaluate their financial health, identify areas for improvement, and plan for future growth. Overall, it is essential to prioritize maintaining proper financial records to ensure the success and longevity of a small business.

Complying with tax laws and regulations

Complying with tax laws and regulations is a crucial aspect of running a small business. It is important for business owners to understand and fulfill their tax obligations to avoid legal issues and penalties. This includes timely filing of tax returns, accurate record-keeping, and payment of taxes on time. Small business owners should also stay updated with any changes in tax laws and regulations to ensure compliance. Seeking professional advice from a tax consultant or accountant can greatly help in navigating the complex world of tax laws and regulations.