Introduction

Definition of personal injury

Personal injury refers to any physical or psychological harm that is caused to an individual as a result of someone else’s negligence or intentional actions. It can include injuries sustained in accidents, medical malpractice, workplace incidents, or even defamation cases. In personal injury cases, insurance companies play a crucial role in providing financial compensation to the injured party. They are responsible for evaluating the extent of the damages, negotiating settlements, and covering the costs of medical treatment and other related expenses. Insurance companies also have the expertise to investigate the circumstances surrounding the injury and determine liability. Their involvement helps ensure that the injured party receives the necessary support and compensation to recover from their injuries and move forward with their lives.

Importance of insurance companies in personal injury cases

Insurance companies play a crucial role in personal injury cases. They provide financial protection to individuals who have suffered injuries due to the negligence or wrongdoing of others. In these cases, insurance companies are responsible for compensating the injured party for their medical expenses, lost wages, and other damages. Without insurance companies, many individuals would struggle to afford the necessary medical treatment and other costs associated with their injuries. Additionally, insurance companies also play a vital role in the legal process by representing their insured clients and negotiating settlements with the opposing party. Their expertise and resources help ensure that injured individuals receive fair compensation for their losses. Overall, insurance companies are essential in personal injury cases as they provide the necessary financial support and legal representation to help individuals recover from their injuries and move forward with their lives.

Overview of the article

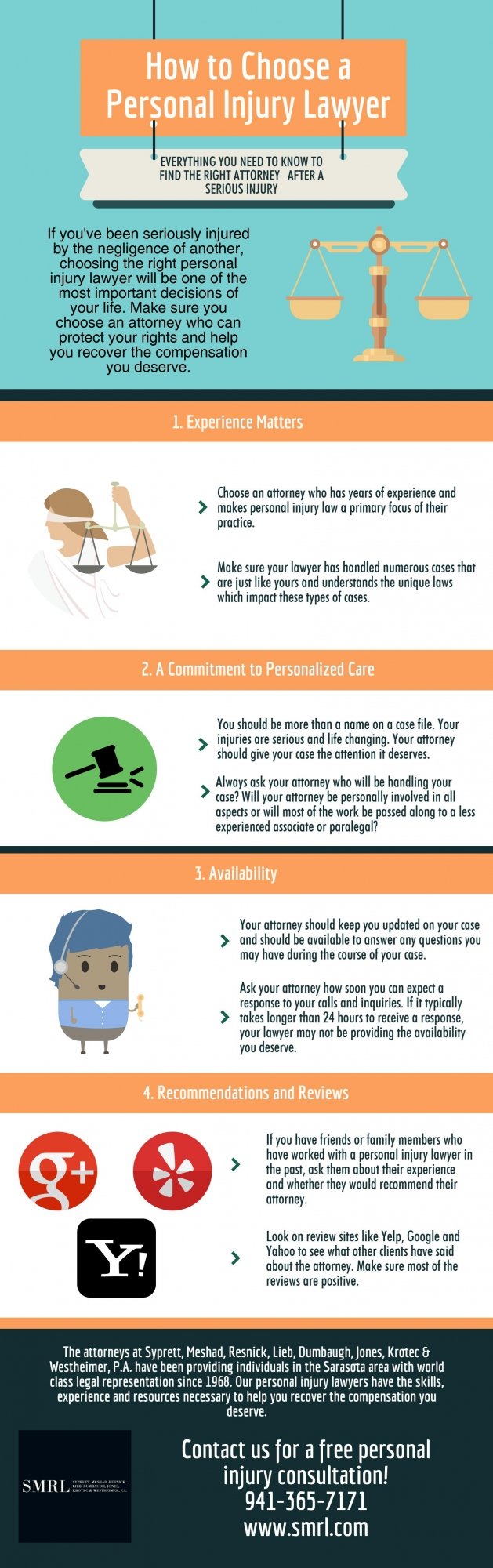

In this article, we will provide an overview of the role of insurance companies in personal injury cases. Personal injury cases involve individuals who have been injured due to the negligence or wrongdoing of another party. Insurance companies play a crucial role in these cases as they are responsible for providing compensation to the injured party. They assess the damages, negotiate settlements, and handle the legal aspects of the case. Understanding the role of insurance companies in personal injury cases is essential for both the injured party and their legal representation to navigate the complex process and ensure fair compensation.

Role of Insurance Companies in Personal Injury Cases

Providing financial protection

Insurance companies play a crucial role in personal injury cases by providing financial protection to individuals. When accidents occur, whether it be a car crash, slip and fall, or medical malpractice, insurance companies step in to cover the costs associated with the injuries sustained. This includes medical expenses, rehabilitation, lost wages, and even pain and suffering. Without insurance companies, individuals would be left to bear the financial burden of their injuries on their own, which can be overwhelming and potentially devastating. By providing this financial protection, insurance companies help ensure that individuals have access to the necessary resources to recover and move forward after a personal injury.

Investigating claims

When it comes to investigating claims in personal injury cases, insurance companies play a crucial role. Their primary responsibility is to gather all the necessary information and evidence to determine the validity of the claim. This involves conducting thorough investigations, reviewing medical records, interviewing witnesses, and assessing the extent of the injuries. Insurance companies also work closely with adjusters and legal professionals to evaluate the liability and potential damages. By conducting a comprehensive investigation, insurance companies ensure that they have all the facts and evidence needed to make informed decisions regarding the claim settlement.

Negotiating settlements

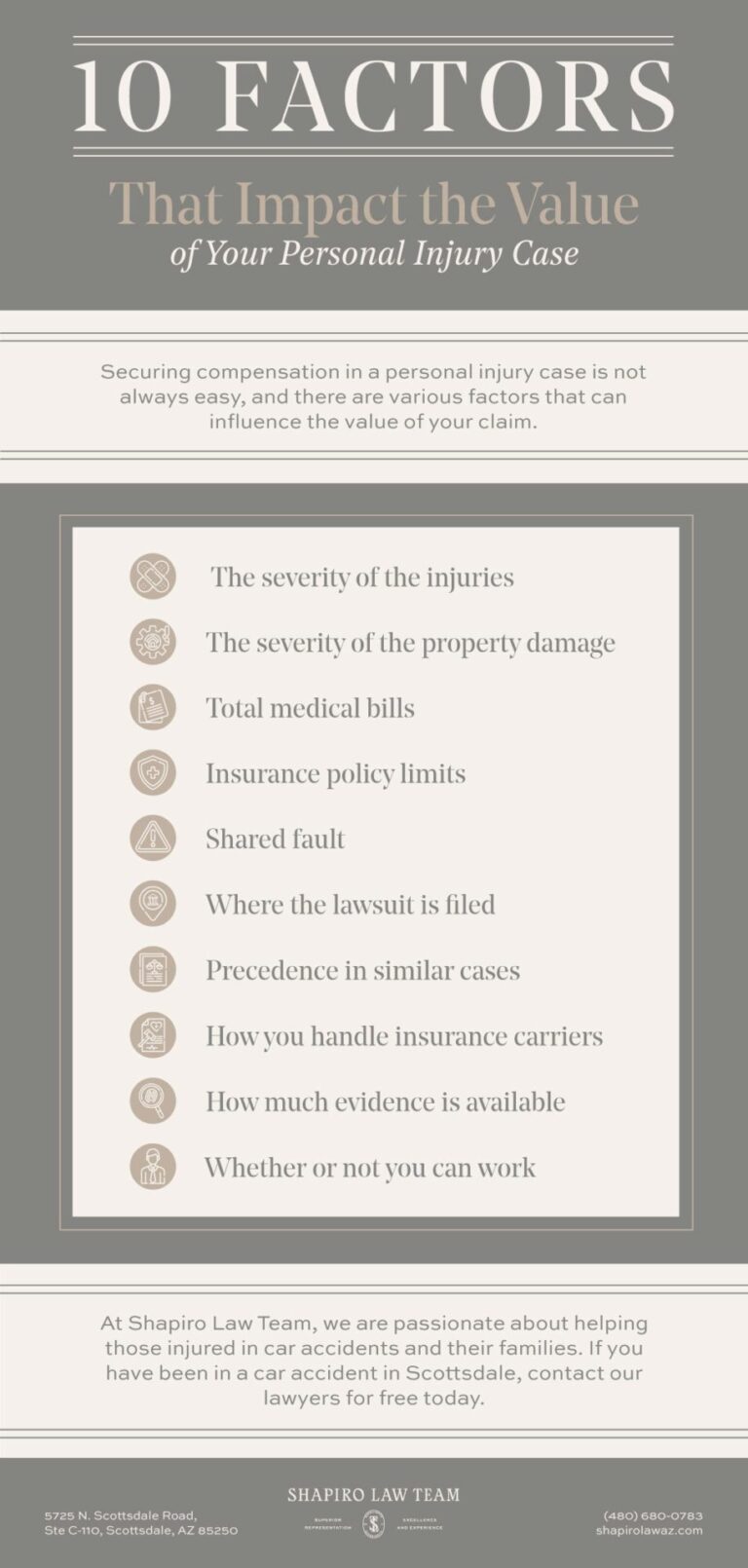

Negotiating settlements is a crucial aspect of personal injury cases, and insurance companies play a significant role in this process. When an individual is injured due to someone else’s negligence, they often seek compensation for their medical expenses, lost wages, and pain and suffering. Insurance companies, as the primary source of coverage for these claims, are responsible for evaluating the extent of the injuries and determining the appropriate settlement amount. Through negotiations, insurance adjusters and personal injury attorneys work together to reach a fair and reasonable settlement that adequately compensates the injured party. These negotiations involve careful analysis of medical records, expert opinions, and other evidence to support the claim. Insurance companies aim to protect their interests while also ensuring that the injured party receives a fair resolution. Successful negotiation of settlements requires effective communication, legal expertise, and a thorough understanding of the insurance company’s policies and procedures.

Types of Insurance Coverage in Personal Injury Cases

Auto insurance

Auto insurance plays a crucial role in personal injury cases. It provides financial protection to individuals involved in car accidents, covering medical expenses, property damage, and legal fees. In the event of an accident, auto insurance helps victims receive compensation for their injuries and damages. Additionally, insurance companies often play a significant role in negotiating settlements and resolving disputes between parties. Without auto insurance, personal injury cases would be much more complex and challenging to navigate. Therefore, it is essential for individuals to have adequate auto insurance coverage to protect themselves and others in the event of an accident.

Homeowners insurance

Homeowners insurance is a type of insurance policy that provides financial protection to homeowners in the event of damage or loss to their property. This insurance coverage typically includes protection against damage caused by fire, theft, vandalism, and certain natural disasters. In the context of personal injury cases, homeowners insurance can play a significant role in providing compensation to individuals who have been injured on someone else’s property. If a person sustains an injury due to a hazardous condition on a homeowner’s property, they may be able to file a claim with the homeowner’s insurance company to seek compensation for their medical expenses, lost wages, and pain and suffering. Homeowners insurance can help ensure that injured individuals receive the financial support they need to recover from their injuries and move forward with their lives.

Medical malpractice insurance

Medical malpractice insurance is a crucial aspect of the healthcare industry. It provides protection for healthcare professionals and institutions in the event of a lawsuit related to medical negligence. This type of insurance is specifically designed to cover the costs of legal defense, settlements, and judgments that may arise from claims of medical malpractice. Without medical malpractice insurance, healthcare providers would be at risk of significant financial loss and potential bankruptcy. Additionally, this insurance plays a vital role in ensuring that patients who have suffered harm due to medical negligence are able to receive fair compensation for their injuries. Overall, medical malpractice insurance is essential for both healthcare professionals and patients, as it helps to maintain the integrity of the healthcare system and promote patient safety.

Challenges Faced by Insurance Companies in Personal Injury Cases

Fraudulent claims

Fraudulent claims pose a significant challenge for insurance companies in personal injury cases. These claims involve individuals who intentionally deceive insurance providers by fabricating or exaggerating injuries, accidents, or damages. Such fraudulent activities not only result in financial losses for insurance companies but also undermine the integrity of the entire insurance system. To combat this issue, insurance companies employ various strategies, including thorough investigation processes, data analysis, and collaboration with law enforcement agencies. By identifying and preventing fraudulent claims, insurance companies can ensure that legitimate personal injury cases receive the compensation they deserve while maintaining the trust and reliability of the insurance industry.

Disputes over liability

Disputes over liability are a common occurrence in personal injury cases, and insurance companies play a crucial role in resolving these disputes. When an accident occurs, determining who is at fault can be a complex and contentious process. Insurance companies are responsible for investigating the circumstances surrounding the accident, gathering evidence, and assessing the liability of each party involved. They work closely with legal professionals and experts to evaluate the extent of the injuries and damages, and negotiate settlements or represent their clients in court. Insurance companies also provide financial support to cover medical expenses, lost wages, and other damages resulting from the accident. Their involvement in personal injury cases helps ensure that the injured party receives the compensation they deserve and that the responsible party is held accountable for their actions.

Rising costs of settlements

The rising costs of settlements in personal injury cases have become a significant concern for insurance companies. As more and more individuals file claims for compensation, the amount of money being paid out in settlements has been steadily increasing. This trend can be attributed to various factors, including the growing number of accidents and injuries, the rising cost of medical treatment, and the increasing complexity of legal proceedings. Insurance companies are now faced with the challenge of balancing the need to provide fair compensation to injured parties while also managing their own financial resources. To address this issue, insurance companies have been implementing strategies such as stricter claim evaluation processes, increased premiums, and the use of alternative dispute resolution methods. These measures aim to mitigate the impact of rising settlement costs and ensure the long-term sustainability of insurance companies in personal injury cases.

Regulations and Laws Governing Insurance Companies in Personal Injury Cases

State insurance regulations

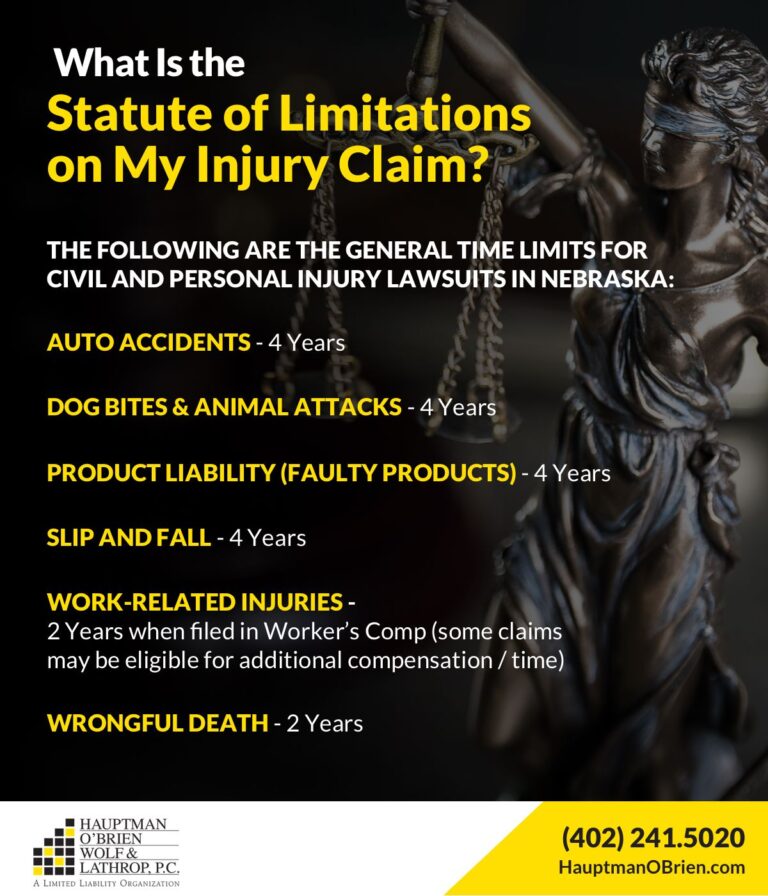

State insurance regulations play a crucial role in personal injury cases involving insurance companies. These regulations vary from state to state and are designed to protect the rights and interests of both the insured and the insurer. They outline the requirements for insurance coverage, the process for filing claims, and the procedures for resolving disputes. State insurance regulations also establish the standards for fair and reasonable compensation in personal injury cases, ensuring that victims receive the necessary financial support to recover from their injuries. By enforcing these regulations, insurance companies are held accountable for their actions and are required to act in good faith when handling personal injury claims.

Insurance contract laws

Insurance contract laws play a crucial role in personal injury cases. These laws govern the agreements between insurance companies and policyholders, outlining the rights and responsibilities of both parties. They establish the terms and conditions under which insurance coverage is provided, including the types of injuries and damages that are covered. Insurance contract laws also dictate the process for filing claims, determining the amount of compensation, and resolving disputes. Understanding these laws is essential for both insurance companies and individuals involved in personal injury cases, as they ensure fair and equitable outcomes for all parties involved.

Tort laws

Tort laws play a crucial role in personal injury cases, and insurance companies are directly impacted by these laws. Tort laws are designed to provide compensation to individuals who have been harmed or injured due to the negligence or intentional actions of others. In the context of personal injury cases, insurance companies often find themselves involved as they are responsible for providing coverage and financial support to their policyholders. These companies play a significant role in the resolution of personal injury claims, as they assess the liability of their policyholders, negotiate settlements, and provide legal representation when necessary. Additionally, insurance companies also contribute to the development of tort laws through their involvement in litigation and lobbying efforts. Overall, the role of insurance companies in personal injury cases is multifaceted, as they serve as both financial providers and active participants in the legal process.

Conclusion

Importance of insurance companies in personal injury cases

Insurance companies play a crucial role in personal injury cases. They provide financial protection to individuals who have suffered injuries due to the negligence or wrongdoing of others. When an accident occurs, insurance companies step in to cover the medical expenses, property damage, and other losses incurred by the injured party. Without insurance companies, individuals would be left to bear the financial burden of their injuries on their own. Additionally, insurance companies also play a role in the legal process by providing legal representation and negotiating settlements on behalf of their insured clients. This ensures that injured individuals have access to the necessary resources and support to navigate the complex legal system and seek fair compensation for their injuries. In conclusion, insurance companies are essential in personal injury cases as they provide financial protection and legal assistance to injured individuals, helping them recover and rebuild their lives after an accident.

Future trends in the insurance industry

In recent years, the insurance industry has witnessed significant changes and is expected to continue evolving in the future. One of the key future trends in the insurance industry is the adoption of advanced technology. Insurance companies are increasingly leveraging technologies such as artificial intelligence, machine learning, and big data analytics to streamline their operations and improve customer experience. These technologies enable insurers to assess risks more accurately, detect fraudulent claims, and provide personalized insurance solutions. Additionally, the rise of digital platforms and online services has transformed the way insurance products are marketed and purchased. Customers now have access to a wide range of insurance options at their fingertips, making the industry more competitive and customer-centric. Another future trend in the insurance industry is the growing focus on sustainability and climate change. Insurers are recognizing the impact of climate-related risks on their business and are taking steps to mitigate these risks. This includes offering insurance products that cover climate-related damages and promoting sustainable practices within their operations. Overall, the future of the insurance industry looks promising, with advancements in technology and a heightened focus on sustainability shaping the way insurance companies operate and serve their customers.

Final thoughts

In conclusion, insurance companies play a crucial role in personal injury cases. They provide financial protection to individuals who have suffered injuries due to the negligence of others. Insurance companies also help in the settlement process by negotiating with the parties involved and ensuring that the injured party receives fair compensation. However, it is important to note that insurance companies are profit-driven entities, and their primary goal is to minimize their financial liability. This can sometimes result in disputes and delays in the claims process. Therefore, it is essential for individuals involved in personal injury cases to seek legal guidance and understand their rights when dealing with insurance companies. By doing so, they can navigate the complexities of the system and ensure that they receive the compensation they deserve.